Contractor paycheck calculator

Well explain why were doing things this way and what this calculator will provide. Easy to use quick way to create your paycheck stubs.

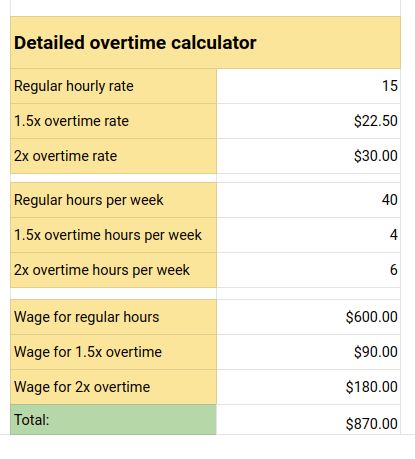

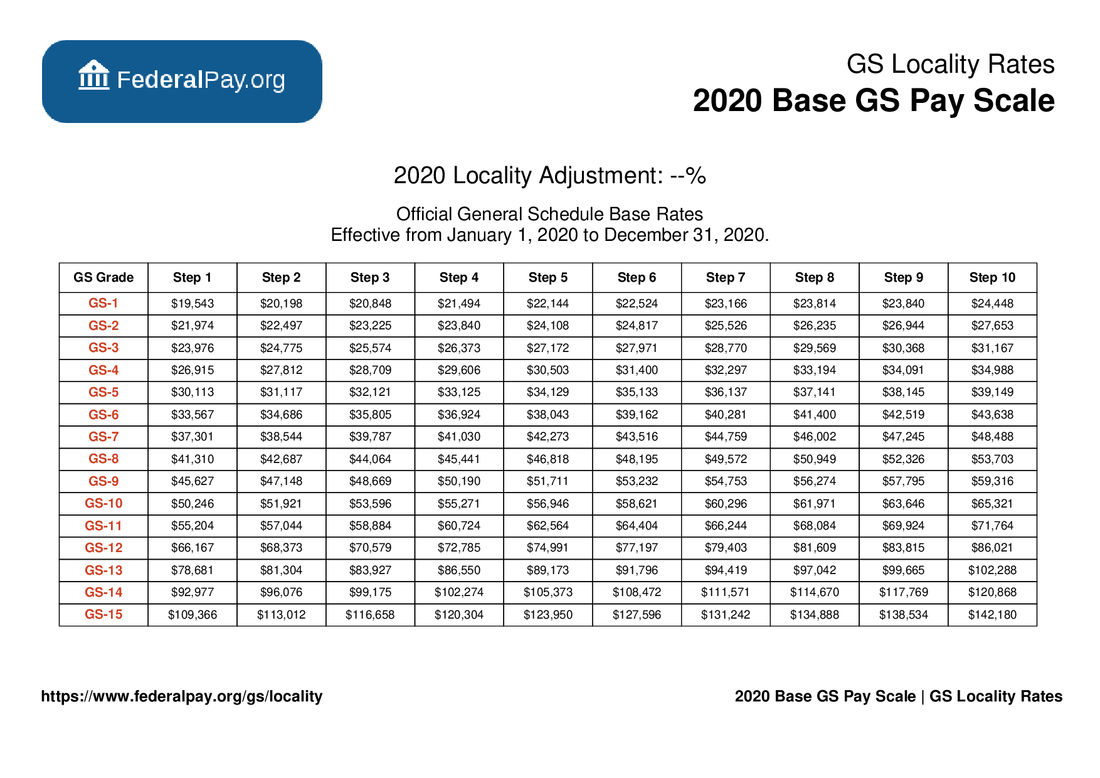

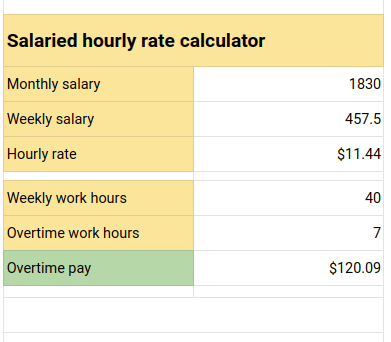

Overtime Pay Calculators

Paycheck Protection Program PPP Loan Calculator.

. It should not be relied upon to calculate exact taxes payroll or other financial data. It should not be relied upon to calculate exact taxes payroll or other financial data. This lets us find the most appropriate writer for any type of assignment.

It can also be used to help fill steps 3 and 4 of a W-4 form. Important note on the salary paycheck calculator. In 2021 the Veterans Health Administration hired the most employees titled Contracting with an average salary of 86634.

In most jurisdictions tax withholding applies to employment income. These calculators are not intended to provide tax or legal advice and do not represent any ADP. You are a member of a partnership that carries on a trade or business.

Government in 2021 with 13916 employed. Enter your pay rate. Our carpet calculator handles the necessary equations for the conversion and our answers are provided in square feet and square yards.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. You can use the calculator to compare your salaries between 2017 and 2022. Important note on the salary paycheck calculator.

RATEucator - Income Brackets Rates. W-4 Check - Paycheck Based W-4 Form. Contractor was the 26th most popular job in the US.

DD 214 Member 4 copy ex-military only. Tax forms and the pay planning calculator electronically. 2022 Tax Calculator Estimator - W-4-Pro.

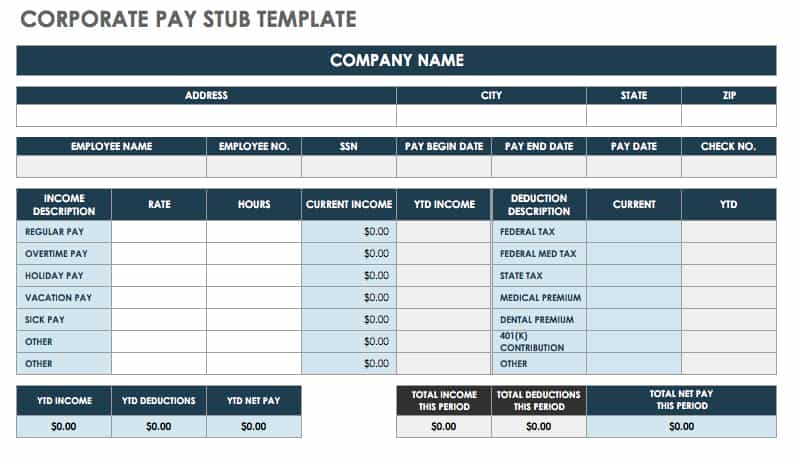

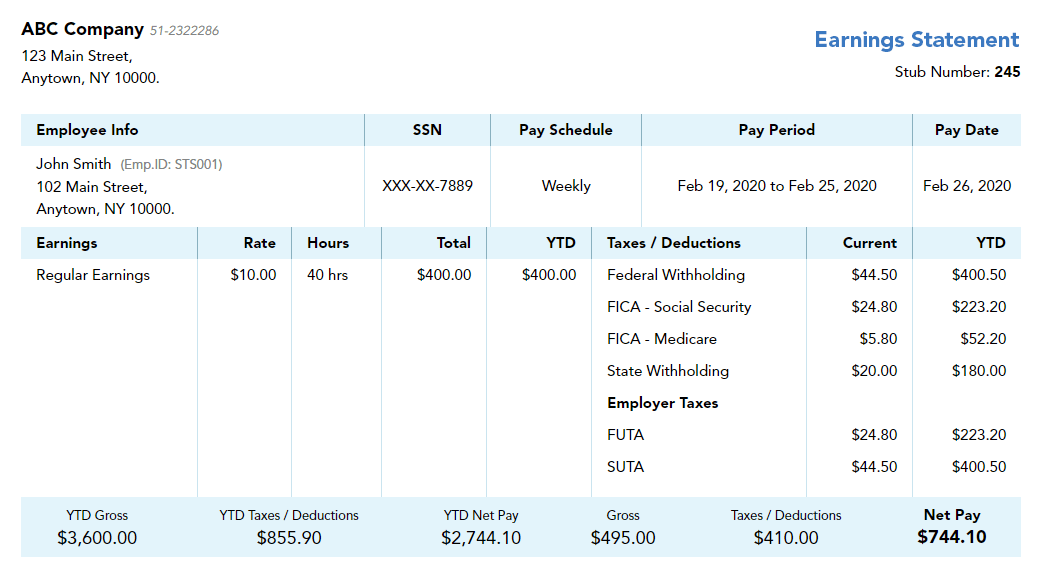

It should not be relied upon to calculate exact taxes. A paycheck calculator lets you know what amount of money will be reserved for taxes and what amount you will actually receive. Free paystub maker tool is specially designed to generate printable pay stubs in PDF format at your Email for easy download share online without repaying.

Use our free mortgage calculator to estimate your monthly mortgage payments. These calculators are not intended to provide tax or legal advice and do not represent any ADP. Going forward well talk about the Doordash tax calculator.

These calculators are not intended to provide tax or legal advice and do not represent any ADP. You are otherwise in business for yourself including a part-time business or a gig worker. If you are self-employed or an independent contractor you will need your net income total after taxes.

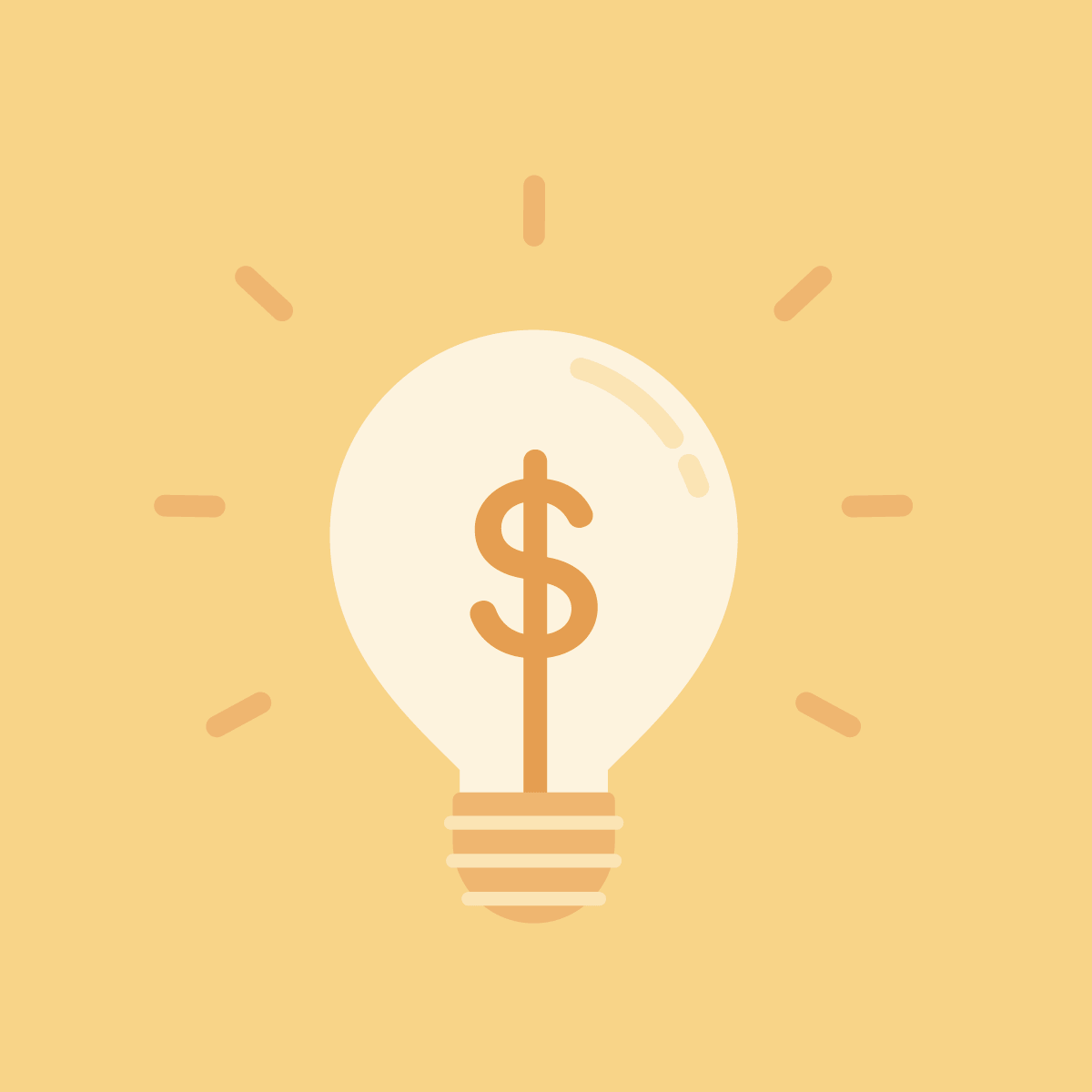

Then enter the employees gross salary amount. When you work as a W-2 employee for a company you automatically have 765 of your income withheld from your paycheck for taxes. Government Contracting jobs are classified under the General Schedule GS payscale.

The tax is thus withheld or deducted from the income due to the recipient. Medicare taxes collectively known as FICA At the same time your employer is paying the IRS an additional 765. Social Security taxes.

Tax withholding also known as tax retention Pay-as-You-Go Pay-as-You-Earn or a Prélèvement à la source is income tax paid to the government by the payer of the income rather than by the recipient of the income. As is the case in all US. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you.

Now you can easily create a Form W-4 that reflects your planned tax withholding amount. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. We launched IDme a safe and easy way to verify your identity in UI.

In this case you are responsible for ensuring that 100 of your FICA taxes are. Compensation paid to an employee in excess of an annual salary of 100000 andor any amounts paid to an independent contractor or sole proprietor in excess of 100000 per year. North Dakota Paycheck Calculator.

There is actually a deduction designed to help self-employed. The amount can be hourly daily weekly monthly or even annual earnings. Try Free Pay Stub creator to generate paystubs without Watermarks online include all company employee income tax deduction details.

Installing new carpet is an easy job that can be done by a handy homeowner or a professional contractor. Exempt means the employee does not receive overtime pay. They can also help calculate the amount of overtime pay will be paid out directly in your check.

2021 2022 Paycheck and W-4 Check Calculator. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Important note on the salary paycheck calculator.

This is a lot of money so make sure to look for all the deductions or credits you can find during tax time. Generally paycheck calculators will show the take-home salary for salaried and hourly workers. While your employer typically covers 50 of your FICA taxes this is not the case if you are a self-employed worker or an independent contractor.

The calculator is updated with the tax rates of all Canadian provinces and territories. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. States you have to pay federal income and FICA taxes.

What are My Self-Employed Tax Obligations. How Your Tennessee Paycheck Works. Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be.

Usage of the Payroll Calculator. The most common payscale was the general schedule payscale. Keep in mind the folowing tips to ensure that your jobs proceed smoothly and according to budget.

W-4 Pro Select Tax Year 2022. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

Account for interest rates and break down payments in an easy to use amortization schedule. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

It should not be relied upon to calculate exact taxes payroll or other financial data. You carry on a trade or business as a sole proprietor or an independent contractor. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

Whether a person is an employee or an independent contractor a certain percentage of gross income will go towards FICA. Contractor Resources Access to everything youll need as a contract employee of Populus Group. W-4 Adjust - Create A W-4 Tax Return based.

Notice to Federal Employees About Unemployment Insurance Standard Form 8 former federal employees only. This is known as FICA and covers. If youre self-employed or an independent contractor youre responsible for covering the full amount of your FICA taxes on your own.

Paycheck deductions begin approximately 30 days after you receive your first paycheck. Important Note on the Hourly Paycheck Calculator. To access paystubs and tax forms prior to October 8 2021.

The calculator wont tell you what you will owe or if youll get a refund as a contractor for Doordash Uber. PAYucator - Paycheck W-4 Calculator.

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Gross Pay And Net Pay What S The Difference Paycheckcity

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

General Schedule Gs Base Pay Scale For 2020

Llc Tax Calculator Definitive Small Business Tax Estimator

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Overtime Pay Calculators

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Free Pay Stub Templates Smartsheet

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

:max_bytes(150000):strip_icc()/calculate-your-selfemployed-salary.asp-ADD-V1-82a71e14d6d64f2b87f10d03a15a8fbb.jpg)

How To Calculate Your Self Employed Salary

Gross Pay And Net Pay What S The Difference Paycheckcity

Independent Contractor Paystub 1099 Pay Stub For Contractors

Calculating Payroll For Employees Everything Employers Need To Know

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Gross Pay And Net Pay What S The Difference Paycheckcity